A non-zero beta coefficients means that there is a significant relationship between the predictors (x) and the outcome variable (y). Once, the beta coefficients are calculated, a t-test is performed to check whether or not these coefficients are significantly different from zero. This method of determining the beta coefficients is technically called least squares regression or ordinary least squares (OLS) regression. Mathematically, the beta coefficients (b0 and b1) are determined so that the RSS is as minimal as possible. Since the mean error term is zero, the outcome variable y can be approximately estimated as follow: This is one the metrics used to evaluate the overall quality of the fitted regression model. The average variation of points around the fitted regression line is called the Residual Standard Error ( RSE). The sum of the squares of the residual errors are called the Residual Sum of Squares or RSS. Some of the points are above the blue curve and some are below it overall, the residual errors (e) have approximately mean zero.

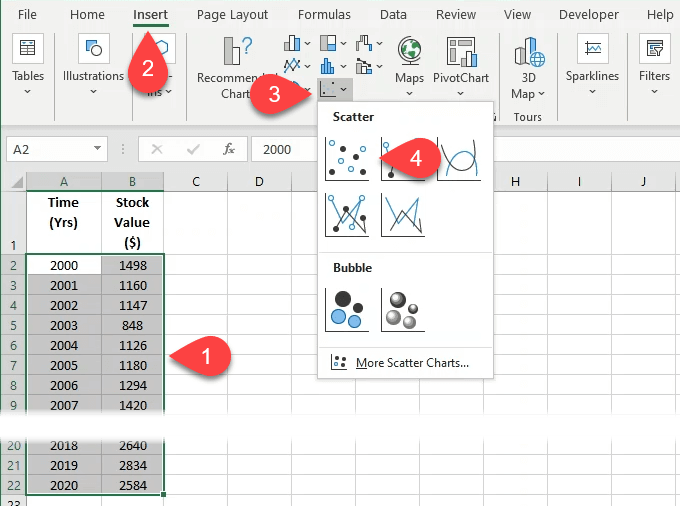

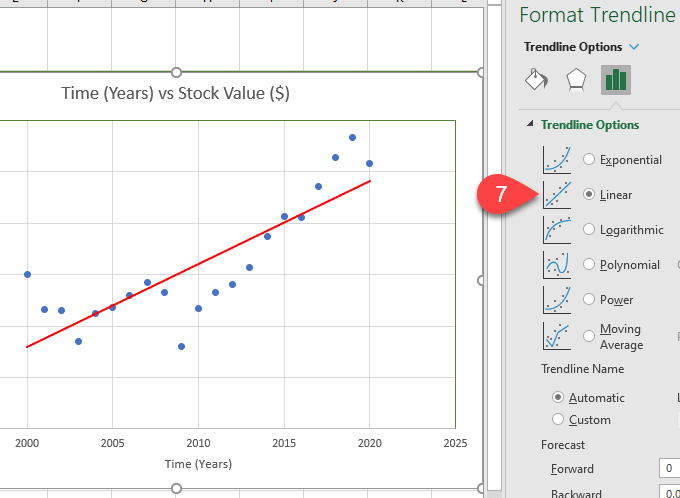

You can copy and paste the data into Excel so you can play along. Our example will have Time in years and Stock Value in dollars. Then we can do some neat things with the trendline and see what it means. The first step is to create a scatter plot.

Let’s assume you haven’t learned all about Excel yet. How To Create An Excel Scatter Plot With Linear Regression Trendline Now we know those words are actually English and what they mean. That line is a simple linear regression trendline through a scatter plot. Could we draw a line through the dots that would show a trend? Let’s call that a trendline.

0 kommentar(er)

0 kommentar(er)